What Does Best Broker For Forex Trading Do?

Table of ContentsThe Of Best Broker For Forex TradingRumored Buzz on Best Broker For Forex TradingThe Main Principles Of Best Broker For Forex Trading Best Broker For Forex Trading Things To Know Before You Get ThisAll About Best Broker For Forex Trading

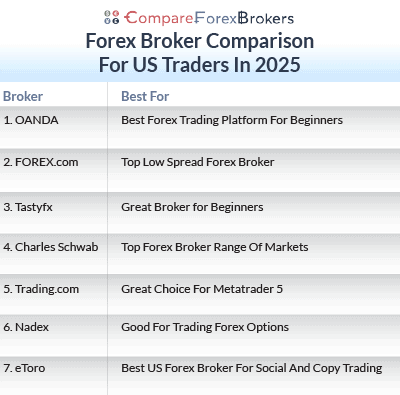

You need to think about whether you can afford to take the high danger of shedding your money. In summary, it is wished that you now have the required expertise to find an on the internet foreign exchange broker that meets your requirements. Whether it is regulation, trading charges, down payments and withdrawals, consumer support, trading tools, or the spread you now recognize what to keep an eye out for when selecting a brand-new platform.Nevertheless, if you do not have the moment to research platforms yourself, it could be worth discovering the top 5 suggested foreign exchange brokers that we have actually reviewed above. Each forex broker masters a certain division, such as reduced costs, mobile trading, user-friendliness, or trust. Ultimately, just see to it that you comprehend the dangers of trading forex online.

This suggests that significant forex pairs are covered to utilize degrees of 30:1, and minors/exotics at 20:1. If the broker is based in the UK, then it should be regulated by the FCA.

With such a big market, there will certainly be always someone going to get or offer any type of currency at the priced estimate rate, making it simple to open and shut professions or transactions any time of the day. However, there are durations of high volatility throughout which it may be not easy to obtain a great fill.

How Best Broker For Forex Trading can Save You Time, Stress, and Money.

Yet as any other market, throughout durations of instability slippage is always a possibility. Greater liquidity additionally makes it hard to control the marketplace in an extensive manner. If a few of its individuals attempt to adjust it, the participants would call for huge amounts of cash (10s of billions) making it almost difficult.

We will discuss this later. The Forex market is an around the clock market. Best Broker For Forex Trading. This means that you can open up or close any placement at any type of time from Sunday 5:00 pm EST (Eastern Requirement Time) when New Zealand starts procedures to Friday 5:00 pm EST, when San Francisco terminates procedures

Some brokers supply up to 400:1 take advantage of, implying that you can regulate as an example a 100,000 US buck deal with simply.25% or US$ 250. This likewise allows us to maintain our risk resources at the minimum. Beware as this is a double-edged sword. If the leverage is not effectively utilized, this can likewise be a drawback.

We will certainly go deeper in to this in the complying with lesson For this reason, utilizing utilize above 50:1 is not suggested. Keep in mind: the margin is made use of as a deposit; whatever else is likewise in jeopardy. The Forex market is taken into consideration one of the markets with the cheapest costs of trading.

The Facts About Best Broker For Forex Trading Uncovered

There are two key players you can't bypass in the foreign exchange (FX) market, the liquidity carriers and brokers. While brokers link investors to liquidity companies and perform trades on part of the traders.

Brokers are people or companies that represent investors to deal possessions. Think about them as intermediaries, facilitating deals in between traders and LPs. Without them, investors would certainly experience trouble with transactions and the smooth flow of profession. Every broker requires to acquire a certificate. They are managed by financial regulative bodies, there more than 100 governing bodies worldwide, these bodies have varying levels of focus and authority.

How Best Broker For Forex Trading can Save You Time, Stress, and Money.

After the parties concur, the broker forwards the LP's offer to the investor. As soon as the price and terms are satisfactory, the trade is executed, and the possession is relocated. To summarize the symbiotic dancing, each celebration take their share of the gained cost. Online brokers charge the investor a compensation while LPs make earnings when they purchase or offer assets at rewarding rates.

We have given three examples to show the partnership in between these events. Digital Communication Networks (ECNs) connect traders to various LPs, they use affordable costs and clear implementation. Below the broker itself works as the LP, in this version, the broker takes the contrary side of the profession. This version proposes faster implementation however, it raises possible conflicts of passion.

When both parties are on the same page, the partnership in between the 2 is normally helpful. A collaboration with LPs makes it less complicated for brokers to fulfil various trade proposals, generating even more customers and boosting their organization. When on the internet brokers access numerous LPs, they can provide competitive costs to traders which improves raised client satisfaction and commitment.

The Buzz on Best Broker For Forex Trading

Let's dive right into the essential locations where this partnership beams. This partnership aids to expand the broker's resources base and allows them to use bigger trade dimensions and deal with institutional clients with substantial financial investment requirements. It additionally broadens LPs' reach with verified broker networks, thus approving the i was reading this LPs accessibility to a larger pool of potential clients.